Why global expansions fail (and how research can save you)

What do Disney, Starbucks, Walmart, Coca-Cola, and eBay have in common?

They all stumbled when expanding globally.

Despite their huge success in their home market, these companies learned the hard way that what works in one country doesn’t automatically translate to another.

As someone with a PhD in behavioral science and psychology, I’ve seen this pattern repeat itself countless times.

What’s behind global expansion fails? A lack of proper research before entering new markets.

In this article, I share how you can avoid being a monumental flop in new markets by using data to drive your global expansion strategy.

Prefer to learn by watching? Here’s the webinar I presented on the same topic.

eBay’s global expansion fail

Let me start with eBay’s expansion into China in 2002, a perfect example of how cultural misunderstanding can derail even the most well-funded global companies.

They wanted to enter the Chinese marketplace for the same reason as other companies: it was the most populous country on the planet.

In 2002, with over a billion people in China, the population was 5 times the amount of the United States. So they thought if we can get even a small portion of that, we can sell more than we can possibly sell in the United States.

eBay had successfully expanded to Australia, Western Europe, and Canada using the same playbook: buy a similar local site and rebrand it.

When they applied this strategy to China, they assumed the market would respond the same way.

They couldn’t have been more wrong.

The fundamental issue came down to cultural patterns—specifically, how trust is built. In the US, we operate on task-based trust: if you complete a task successfully, I’ll trust you for future transactions.

But China operates on relationship-based trust: people need to communicate and build personal connections before they’ll do business together.

While eBay maintained their standard, information-light interface, Alibaba launched Taobao with instant messaging features that allowed buyers and sellers to chat. This simple difference aligned perfectly with Chinese cultural expectations and contributed to eBay’s eventual retreat from the market.

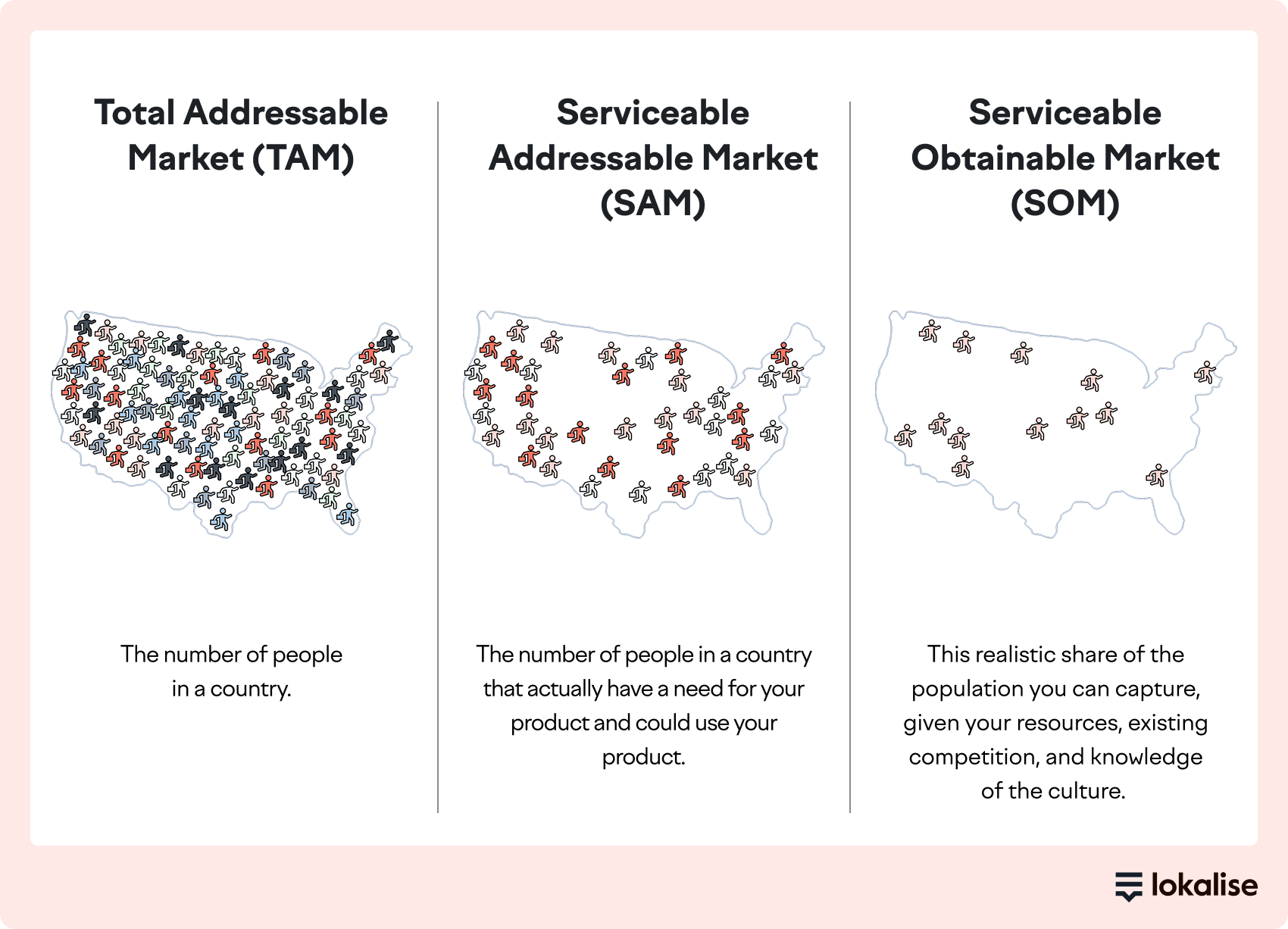

The lesson? Your Total Addressable Market (TAM) means nothing if you don’t understand your Serviceable Obtainable Market (SOM): the realistic share you can capture given cultural constraints, competition, and local market dynamics.

And the only way you can identify the SAM and the SOM is by doing research to understand your target country, their needs, their context of uses, and how they view the world.

Given that this is so hard and that it requires research, is anybody doing this well?

McDonalds’ research that leads to global success

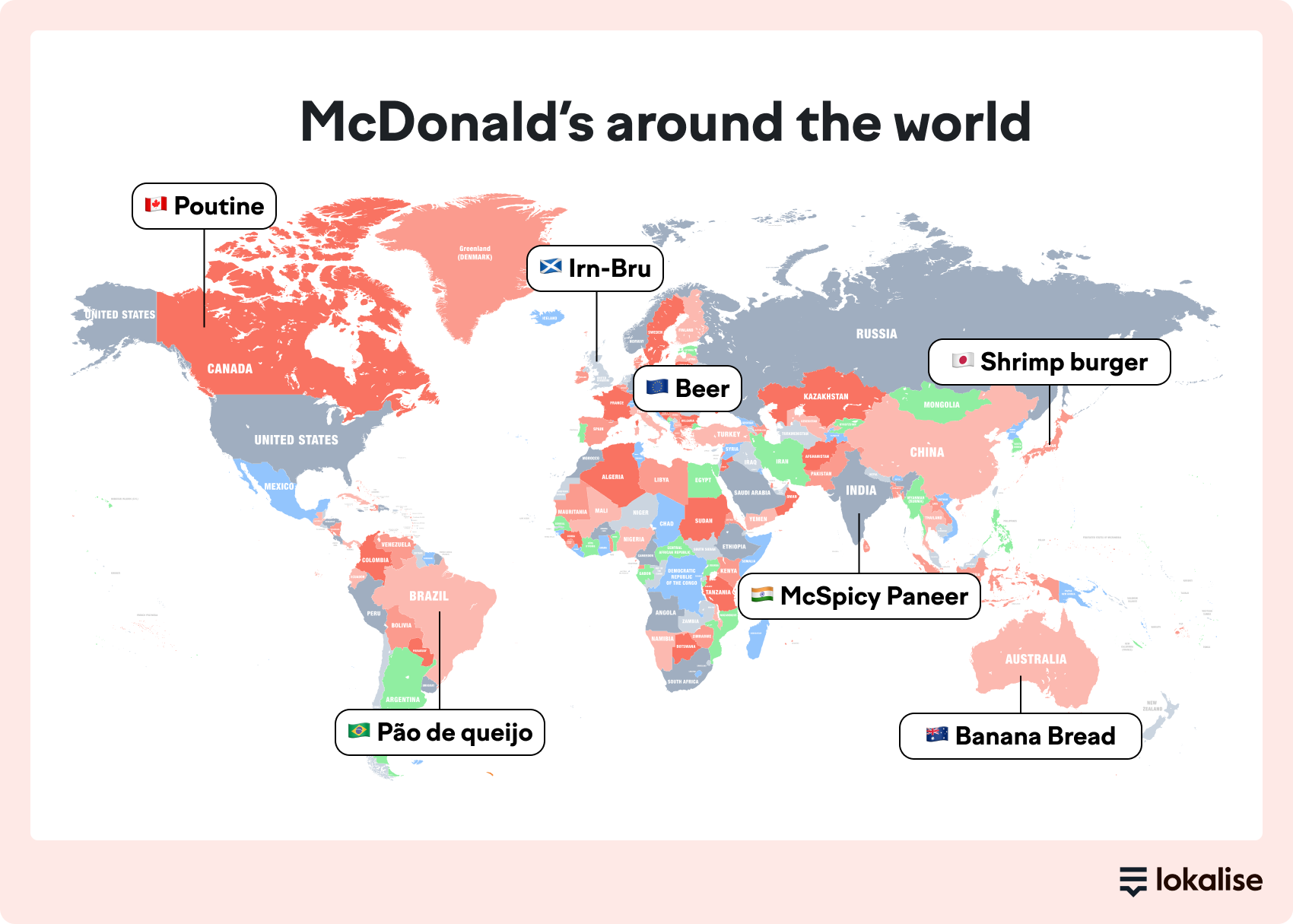

Now contrast eBay’s approach with McDonald’s global strategy.

Yes, you can get a Big Mac, fries, and Coke anywhere in the world: that’s their universal brand promise.

But they are smart enough to recognize that not everybody wants a Big Mac, nuggets, fries, and a Coke, or at least not all the time.

And so they do research about the countries that they are planning to enter, and then they continue to do research in those countries to understand the tastes of those individuals.

Just enter a McDonald’s anywhere in the world, and you’ll notice that the menu is adapted for local tastes:

In Brazil, they serve Pan de Queijo (cheesy bread), beer in Europe, Iron Bru in Scotland, and a McSpicy Paneer in India.

So, McDonald’s secret sauce? Continuous user research.

No matter where customers are in the world, McDonald’s understands what they want to see on the menu, making them one of the most successful global brands in history.

Here are some more examples of brands getting global expansion rightly.

Practical tips and my process for global user research

Given that research is so important to market success and especially global expansion, I’m gonna talk a little bit now about my approach to research.

Benjamin Franklin said it best: “If you fail to plan, you are planning to fail.”

This is especially true for international research where cultural missteps can invalidate your entire data set.

After years of studying human behavior and working with global companies, I’ve developed a research approach grounded in cognitive science.

Here’s how I think about the process:

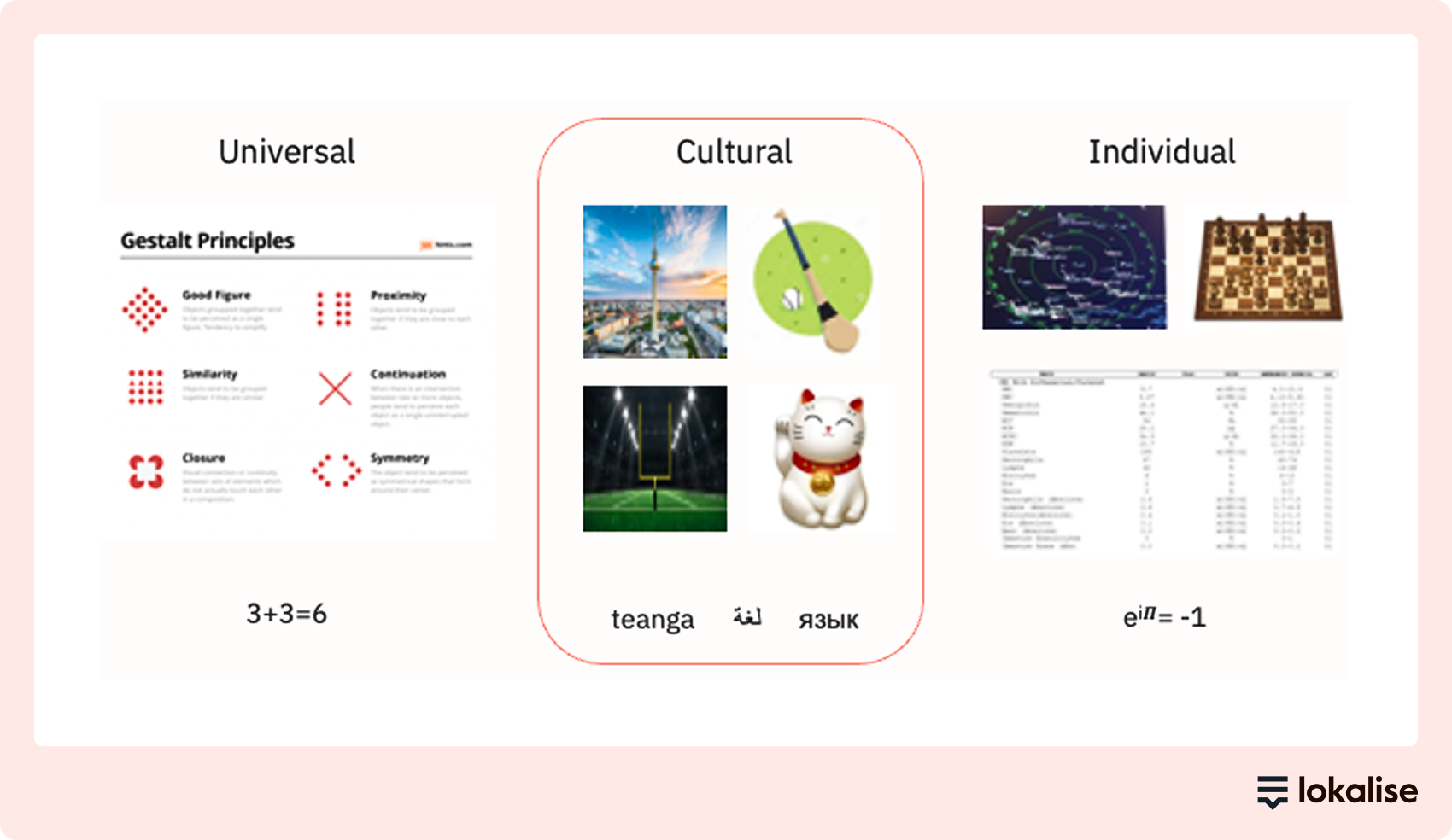

Every user interaction passes through a cognitive filter that recognizes three types of patterns:

- Universal patterns (Gestalt principles, basic math)

- Cultural patterns (language, symbols, social norms)

- Individual patterns (expertise, personal experience)

Now, these patterns are really important because they’re components of usability.

In the 1990s, the International Standards Organization defined usability as the ability of a product or service to assist specified users in accomplishing specified goals with efficiency, effectiveness, and satisfaction in a specified context of use.

But I really want to focus on the specified users.

A product cannot be usable for every user on the planet. It has got to be usable for some subsection of users, and it might be a broad subsection of users, but it needs to be adapted to be usable by the broadest group of users.

And one of those adaptations is culture.

For global expansion, cultural patterns are key. They help you understand how people in different regions process information, build trust, and make decisions.

My three-phase research process for collecting data

I map research activities to three phases of product development:

Phase 1: Understanding needs (formative research)

- What are users’ goals in this market?

- How are these goals currently being met?

- How do users define ‘effective,’ ‘efficient,’ or ‘satisfying’?

Phase 2: Exploring solutions (directive research)

- How will our solution change user behavior?

- What could go wrong, and how likely is it?

- Which solution best fits local user capabilities?

Phase 3: Delivering & Measuring (Evaluative Research)

- Is our design actually usable in this context?

- Why are (or aren’t) we meeting our KPIs?

- How can we expand successful patterns?

The bottom line: research is key

Global expansion failures are preventable through proper research. The companies that succeed internationally don’t just translate their products; they adapt them based on deep understanding of local markets.

Here’s what I want you to remember:

- Cultural patterns matter as much as universal ones for user experience

- Research should happen in three iterative phases throughout development

- Planning isn’t optional—it’s the foundation of valid insights

The difference between eBay’s failure and McDonald’s success isn’t luck or resources. It’s the commitment to understanding users before asking them to change their behavior.

Ready to build your research strategy?

Want to dive deeper into these research methodologies? Watch the full webinar where I walk through detailed examples, answer audience questions, and share additional frameworks you can implement immediately.

Don’t let your global expansion become another cautionary tale. Start with research, and turn your international growth from guesswork into a data-driven strategy.

Have questions about implementing these research approaches? Connect with me on LinkedIn or join our Lokalise Lab to participate in ongoing research studies.

Author

Rebecca is a UX Research Lead at Lokalise. She brings a strong background in guiding product strategy through research across sectors including SaaS, automotive, and government. She joined Lokalise to help build research-driven products that empower customers to expand into new markets with deeper cultural insight, better usability, and greater confidence.

Stop wasting time with manual localization tasks.

Launch global products days from now.

Case studies

Behind the scenes of localization with one of Europe’s leading digital health providers

Read more Case studies

Support

Company

Localization workflow for your web and mobile apps, games and digital content.

©2017-2026

All Rights Reserved.