What are blockchain and crypto?

A blockchain is a digital chain. Each link in the chain (i.e. each block) has encrypted data about when it was added to the chain and a record of the link before it.

It’s nearly impossible to change the information in any one block without changing the information in all the other blocks in the chain, making it a secure register of events, even if it can be accessed by anyone.

Blockchain is the technology that supports some of the world’s most popular cryptocurrencies. These currencies are completely virtual. Instead of relying on a centralized institution to back or track them, they rely on a blockchain and cryptography.

The past and present of cryptocurrencies

Since the early 1980s, cryptographers, researchers, and economic institutions have been discussing the creation of cryptographic digital money.

But the first cryptocurrency, Bitcoin, didn’t actually hit the market until 2009, launched by a mysterious developer (or team of developers) going by the name Satoshi Nakamoto. Since then, many blockchain-based cryptocurrencies have followed.

Although cryptocurrencies had a reputation for their use on black markets, today they’re used for plenty of above-board online transactions.

Bitcoin, Ethereum, and other currencies like them are also popular among currency traders, and some private firms have created their own versions for internal use. For example, in 2018, Singapore Airlines developed a blockchain-based digital wallet for its frequent flyer program.

Localizing a decentralized service

Cryptocurrencies may be a borderless solution for international commerce, but the people they serve still live in local societies. All crypto users show up with their own native language, expectations, and local needs.

Meanwhile, this relatively new industry, based on innovative technology, presents brand new localization challenges. All over the world, economic and legal institutions are scrambling to figure out what cryptocurrencies mean and how to respond to them. The result is that users around the world have vastly different opportunities to use cryptocurrencies.

Regulations continue to change, presenting crypto companies with fresh challenges and fresh global opportunities every day. But to capture those opportunities, these businesses need to be prepared to localize quickly and well.

Crypto localization challenges and best practices

Technical content

Understanding blockchain currencies requires a tricky combination of computing and finance. Just like legal, medical, and literary translation, blockchain and the crypto industry are their own area of translation expertise.

For us at BLEND, this means maintaining a lineup of linguists who specialize in blockchain and cryptocurrencies. Cryptocurrency clients work with dedicated, pre-approved teams.

For example, one of our clients Fortrade’s team of translators has been able to learn more about the client’s preferences over many different projects. Specialized teams like this allow clients to form a relationship with their localization specialists and they come to trust the translators to understand their product and their business model.

User experience

In a growing industry, the user interface can easily make or break the customer experience. Users of cryptocurrency wallets and trading platforms need to be able to navigate these new platforms easily, while still taking in a lot of technical and legal information.

UI localization is critical. Besides translating the text, translators should work closely with designers and developers. Together, the localization team can ensure that content elements are culturally appropriate, as well as clear and consistent across all devices and screen sizes.

We do this with a combination of message boards and project notes. In one case, a large crypto company even held intensive kickoff meetings with their entire translation team. This let the translators get to know the company’s preferences and the detailed layout of the platform and scope of the project before they began their work.

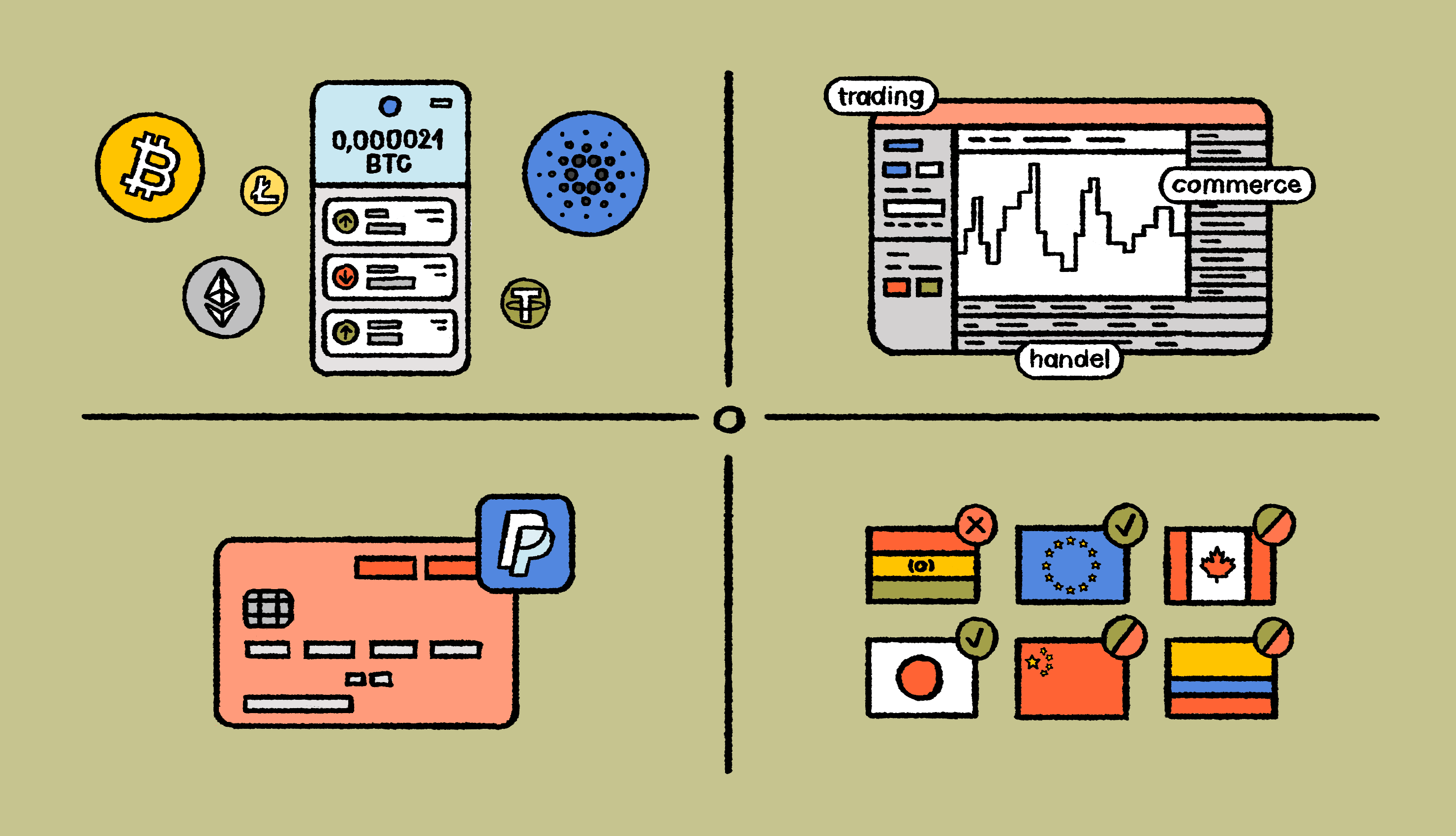

Payment methods

Users don’t need to put down any money to mine cryptocurrencies. But users who want to start trading or using crypto without mining it need to make a deposit. Therefore, crypto trading sites need to localize payment methods just as much as any ecommerce business.

PayPal and credit cards are the most common methods across the world. However, the specific credit cards that are popular vary by country, and many regions have their own PayPal alternatives. As with all ecommerce, the best practice is to make it easy for your customers to give you money. Accepting the payment methods that they’re used to is a vital step.

This is a perfect example of where localization goes well beyond translation. Particularly in the crypto industry, a broad perspective and consistent monitoring are required. At BLEND, we do this with Local Insight Reports, but any type of repeated, detailed localization audit can make sure these elements aren’t forgotten.

Legal compliance

Once again, we return to the fact that the crypto industry is new. Governments are still deciding what to do with it - and they are all making different decisions. Some countries have completely legalized it, while others have banned its use.

Most have done something in between. Crypto brokers must know the applicable legal requirements for every local market in which they operate.

That’s why the translation teams for our clients Qiwwie, Fortrade, and other crypto companies include two types of translators: crypto specialists and legal experts. The legal sensitivity of crypto means that expert local translators should always be involved in the localization process.

The future of crypto’s global expansion

The growth of cryptocurrencies has slowed over the years, but their benefits make them likely to stick around long term.

Because they’re not directly intertwined with other markets, investors and traders will likely keep using them to diversify their portfolios. In countries with plummeting currencies, they can even seem like a stable alternative. Meanwhile, blockchain technology is being adapted for more purposes every day.

This all adds up to continued international growth for the crypto industry, and with it, the continued need for localization.

Linguists and localization professionals who are ready to take on the challenges of specialized technology, widely varied regulations, and different economic perspectives, will help ensure local success for crypto’s global expansion.

By the way, have you checked why Lokalise makes a great localization software for growth-oriented finance companies? Head over to this page to check it out.